By Mauro Nogarin

According to the Organization for Economic Cooperation and Development (OECD) in 2021, the Mexican economy is expected to have a growth of 5% due to an increase in manufacturing exports and benefiting from the economic recovery of the United States.

Although on one hand there is a strong boost in external demand, with the export of manufactures, on the other hand with less dynamism, consumption and investment have to be reinforced through private investment for a more solid recovery of the Mexican economy.

According to figures from the National Statistics Institute (INEGI) updated at the end of 2020, the construction industry contributed 6.7% of the gross domestic product.

In the annual comparison, in March 2021, the value of production generated by construction companies fell by 10%, while the personnel employed in this sector decreased by 5.9%. Real average wages increased 1.4% in the reference period.

According to a new report from the Mexican Chamber of Construction Industry (CMIC), the sector is stagnant and may worsen if there are no improvements in the second half of 2021.

The president of CMIC Puebla, Héctor Sánchez Morales, commented that for the 300 partners, it is even more complicated because a large number of public works tenders have not been launched by the state government and the municipalities that make up the metropolitan area.

During the pandemic in 2020, there was a shortage of materials and those that did have material saw increases of 30% in the prices of products such as copper and steel, with the exception of cement, which remained quite stable because the factories did not stop producing.

The construction sector hopes, if not to recover fully, that it at least does not continue the decreasing trend over the next six months.

The CMIC estimates that in 2020 the Gross Domestic Product (GDP) of the industry fell 15%, in addition to having lost between 200,000 and 300,000 jobs.

However, even with these negative figures, it is forecast that this year the industry will grow 3% in GDP, mainly driven by the plan and the sum of investments that are being developed throughout the year. Positive figures can be seen at the end of the second semester.

Most of the works were not consolidated during the first part of 2021, so the reactivation of the sector with large-scale projects will be slow.

In its latest report, the Mexican Real Estate Bank (BIM) estimates that at the national level the private real estate sector will strengthen with 182,000 homes, which represents a growth of 19.8% compared to the same period in 2020.

Regarding public works, the construction of the Dos Bocas refinery, the General Felipe Ángeles International Airport (AIFA) and the Mayan Train, never stopped during the first year of the pandemic. Construction on these projects continued to generate sources of employment and a certain stability in the production of cement at the main national factories.

But the concrete segment, according to a study by the Asociación Mexicana de Concreteros Independientes (AMCI), which covers 550 companies in the country and has around 1,250 plants that represent 60% of the national market, the situation remains difficult due to the high price of cement as the margins of their companies have decreased. The increase in cement prices in recent years was around 73%, while the increase in volumes has reached 17%.

Large companies such as Cemex and Holcim offer a concrete price well below the market benchmark since they are also cement manufacturers.

What currently drives the demand for concrete for small and medium-sized companies that belong to the concrete association is private work.

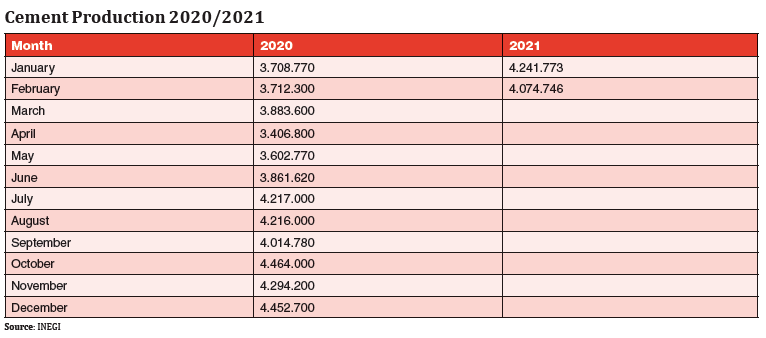

In January of this year, according to data from the national statistics institute (INEGI), the industry produced 4.2 million tonnes, 533,000 t higher than in 2020 and 669,000 t higher than in 2019.

Last year’s total production volume reached 47 million tons, 20.14% more than in 2019.

This data is explained when on April 6, the government published in the Official Gazette that it was determined to include cement and concrete within industries that were considered essential activities. That allowed for the industry to continue working 24/7, three shifts, and under a series of health protocols.

According to the latest data available from INEGI, the prices of construction materials in Mexico increased by 2.1% in February 2021, compared to the previous month.

That increase represents the eighth consecutive month of increases in material prices, although most of the increase in prices was recorded in January 2021, when construction materials registered a monthly inflation of 3.5%. The highest price increase is located in products derived from steel, with steel mesh being the wire product that increased the most in the month, registering an increase of 6.9%. Likewise, metal structures had an increase of 4.7% during the month of February, while rebar became more expensive 5.6%.

Ready-mixed concrete and cement had increases of 0.56% and 0.25%, respectively.

Mauro Nogarin is Cement Americas’ Latin American contributor.