Cement Consumption Is Directly Related to the Distribution of the Country’s Population, With the Buenos Aires Region Representing 42% of the Total.

By Mauro Nogarin

Despite the economic-financial crisis, the Argentine cement industry continues to maintain its profitability and one of the most important companies in the sector, Loma Negra, was able to carry out one of its largest investments in recent years to increase its productive capacity.

Despite the economic-financial crisis, the Argentine cement industry continues to maintain its profitability and one of the most important companies in the sector, Loma Negra, was able to carry out one of its largest investments in recent years to increase its productive capacity.

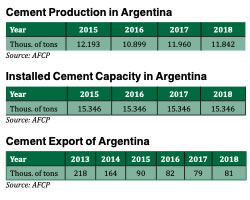

The Argentine cement industry in mid-2018 halted its positive consumption trend, starting a decreasing trend. The year ended with a smaller volume by 2.6% compared to the previous year. Devaluation, inflation and the lower level of activity are related to this particular evolution of the industry (Box 1).

However, in May 2019 cement shipments rose again. Cement shipments in May reached 973,655 tons, a 4.7% increase in a year-on-year comparison, according to the report of the Portland Cement Manufacturers Association (AFCP). This was the first increase since April 2018.

In the first five months of 2019, 4,647,487 tons were dispatched, still 5.4% less than the 4,915,070 tons in the January-May 2018 period. Likewise, cement shipments in May of this year were 7.1% higher than in April.

From a geographical point of view, cement consumption is directly related to the distribution of the country’s population, with the Buenos Aires region representing 42% of the total, followed by the Central and Northwest regions.

In 2018, the infrastructure plan started the previous year by the national government continued, accompanied by the execution of private works in different areas of the country. This meant that the volume of cement consumed in bulk was greater than the previous year, becoming a historical record for the Argentine industry. The high proportion of bulk cement in total shipments confirms the trend that has been taking place in recent years.

Loma Negra recorded shipments of 6.1 million tons in 2018 in all its product lines – bagged cement, bulk, masonry and lime – which was a decrease of 4.6% when compared to the previous year. Even so, this volume allowed Loma Negra to continue to maintain its historic leadership in the Argentine market.

Loma Negra recorded shipments of 6.1 million tons in 2018 in all its product lines – bagged cement, bulk, masonry and lime – which was a decrease of 4.6% when compared to the previous year. Even so, this volume allowed Loma Negra to continue to maintain its historic leadership in the Argentine market.

The company in 2018 also continued the expansion activities of its L’Amalí plant, which will increase capacity by an additional 2.7 million tons from the first quarter of 2020 with the aim of optimizing its production model.

Additionally, expansion works were carried out at the Olavarría plant, which will increase the production capacity of hydrated limes by approximately 15% until the end of 2019.

Additionally, expansion works were carried out at the Olavarría plant, which will increase the production capacity of hydrated limes by approximately 15% until the end of 2019.

Lomax, the Loma Negra brand that produces various types of concrete according to different construction requirements, was present in most of the infrastructure works located in Buenos Aires and Rosario.

According to the recent financial report for the second quarter 2019, the sales volumes of cement, masonry and lime in Argentina during the second quarter of 2019 declined by 10.4% to 1.33 million tons. As in previous quarters, the bag segment continued to suffer further than the bulk segment, which was supported by an incipient recovery in the private sector.

In Paraguay, sales volumes decreased by 1.2% in the second quarter to 0.12 million tons mostly explained by adverse weather conditions, partially offset by higher market participation. As a result, consolidated total sales volumes of cement, masonry and lime for the quarter decreased 9.7% to 1.46 million tons.

Sales volumes in the concrete segment in Argentina were down 12.8% to 0.22 million cu. meters, given that several large infrastructure projects that had commenced in recent years were in the completion phase.

Railroad segment volumes experienced a 2.4% decline versus the comparable quarter in 2018, affected by lower transported cement. By contrast, aggregate volumes increased by 18.5%.

Despite the difficult economic situation and the impending political elections on October 27, 2019, the company continued its investment program with the objective of satisfying demand. In fact, at the L’Amalí plant, work continued to expand the production line to increase the installed capacity by 2.7 million tpy with a capacity of 5,800 tons per day of clinker. This expansion implies an investment of approximately $350 million with an estimated total execution time of 31 months and is expected to be completed at the beginning of 2020, thus expanding its installed capacity by 40%.

Despite the difficult economic situation and the impending political elections on October 27, 2019, the company continued its investment program with the objective of satisfying demand. In fact, at the L’Amalí plant, work continued to expand the production line to increase the installed capacity by 2.7 million tpy with a capacity of 5,800 tons per day of clinker. This expansion implies an investment of approximately $350 million with an estimated total execution time of 31 months and is expected to be completed at the beginning of 2020, thus expanding its installed capacity by 40%.

The plant in Catamarca purchased a stone analyzer that will improve the quality of the cement. A drilling machine was also replaced to improve the efficiency of the quarry.

Also at the Olavarría plant, work continued on the expansion of the lime dispatch, and a change in the bagging and palletizing line was completed in the first quarter of 2019, with the aim of increasing the capacity for bagging, palletizing and clearance of lime.

In the concrete business, concrete trucks were acquired, accompanying the growth of a greater demand for concrete.

Mauro Nogarin is Cement Americas’ Latin American contributor. From 1997 to 2001 he was a reporter for the Italian news agency ASCA from Germany to follow the economic events of ECOFIN. At the same time, he began a strong partnership with the Italian magazine Focus with issues related to European scientific research. Back in Italy after six years of residence in the city of Heidelberg (Germany), he worked from Italy for the weekly Stern and Bild Zeitung. Since 2005, he has lived in South America (Bolivia) and worked with the Italian geopolitics review Limes, the Italian gas and oil journal Staffetta Quotidiana, the Colombian oil magazine Petroleo Internacional, the German RE Sun and Energy, the U.S. magazine Renewable Energy World (Pennwell), the World Energy Project (Università di Bologna), Pan Americana Construction magazine and Worldoil magazine. He can be reached at [email protected].